re.life announced the milestone AED100 million worth of trades for re.life market, reaffirming its commitment to creating mutually beneficial trade relationships in the recyclables trading industry and accelerating the circular economy.

re.life market shared to have recorded over 150,000 tonnes of recyclable material being traded on the platform in 2022, amounting to over AED100 million in value. This is a major milestone for the platform, which was launched by re.life in 2021, and a powerful indicator of the shift in the industry towards more efficient and sustainable ways of trading recyclables.

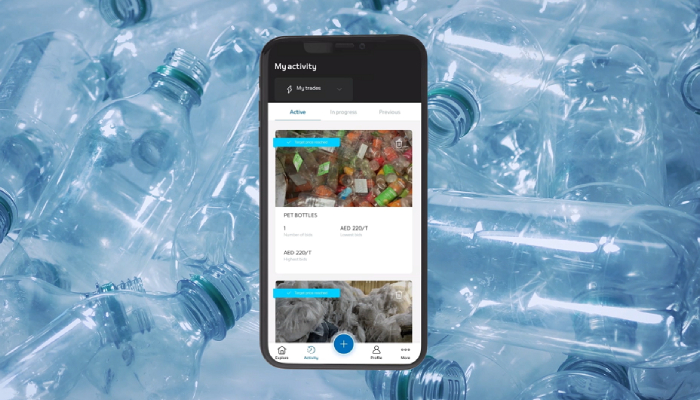

The re.life market platform connects buyers and sellers of recyclables in a virtual B2B marketplace, with several trade options for a transparent and fair bidding process that meets the specific needs of buyers and sellers. Trades are possible across categories of recyclables, including ferrous and non-ferrous metals, plastic, paper, wood, e-waste, glass, and rubber. re.life market also verifies the quality of recyclables being traded on the platform and provides guarantee of payment to sellers when a trade is completed.

While buyers are guaranteed that high-quality recyclables will be allocated to them, sellers have the assurance of receiving payment. Buyers also have greater access to in-demand material and sellers are empowered to command fair prices. Of the over 150,000 tonnes of recyclables traded on the platform to date, metals, plastic, paper and aggregates were the most traded categories.

Speaking on the development, Salim Sultan Al Owais, CEO, re.life, said, “The UAE is a dynamic market looking to accelerate its recycling and sustainability targets, which has enabled re.life market to succeed as a catalyst for recycling. Major companies in the UAE have joined the re.life market platform, as there are clear benefits of better market visibility, greater transparency, and ease of doing business on the platform. At the same time, we are also accelerating the circular economy here in the UAE.”

The re.life CEO added that new technologies are informing the digital roadmap for the re.life market platform. The digital venture has set up an office in India to acquire new technologies, further optimise the platform for the best user experience and facilitate trades of recyclables in new economies. The new office in India will also allow exploration of the massive market for domestic and international recyclables trading.

“To be future-ready, we are keeping up with the latest technologies and exploring the addition of new features that will nurture a seamless experience and create the best possible outcomes for buyers and sellers on the platform,” Salim Sultan Al Owais added.

Currently, the re.life market platform has multiple trading options to address the unique needs of both buyers and sellers. The platform has both time-limited bidding and bid-free options. Apart from traditional bidding, the platform offers “partial bidding”, “spot sale” and “spot buy”. For spot sales, sellers specify a material, its quantity and price. The material is then assigned to the buyer who establishes proof of intent to purchase. Similarly, buyers can state a material, quantity, and price, with interested sellers having the option to approach them through the “spot buy” trading option. The re.life market platform currently has over 300 buyers and sellers of recyclables in UAE and India.